- Weekly market focus

- U.S. payroll report may delay QE tapering

- House expected to finalize passage of the debt ceiling increase on Tuesday

- Covid infection levels continue to steadily drop

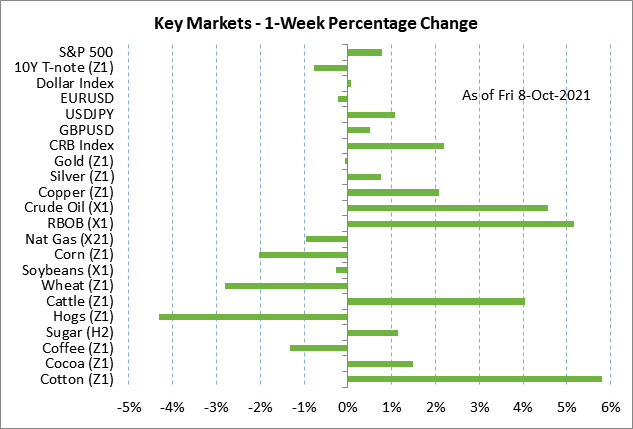

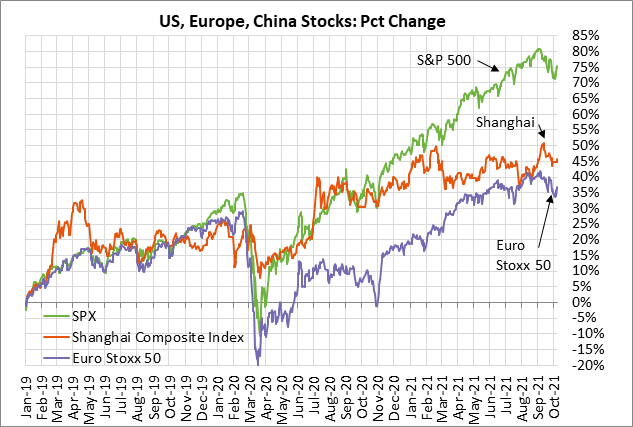

Weekly market focus — The markets this week will focus on (1) Fedspeak and whether Fed officials suggest they might delay the timing of QE tapering due to last Friday’s weak payroll report, (2) whether the Covid infection figures continue dropping this week, (3) the beginning of Q3 earnings season this week with reports from the big Wall Street banks, (4) the Treasury’s sale of 3 and 10-year T-notes on Tuesday and 30-year bonds on Wednesday, (5) the inflation outlook with the CPI report on Wednesday and PPI report on Thursday, and (6) the U.S. consumer spending outlook with Friday’s Sep retail sales report (expected -0.2% m/m after Aug’s +0.7%).

U.S. payroll report may delay QE tapering — Last Friday’s weak Sep payroll report of +194,000 may cause the FOMC to delay a tapering decision until its December meeting. The markets had previously thought the FOMC might announce QE tapering at its next meeting on November 2-3. However, the weak payroll report appeared to fall short of the “substantial further progress” in the labor market that the FOMC has set as a standard for moving ahead with QE tapering.

The markets had been expecting much stronger payroll growth of +500,000 in September since the Covid infection figures started falling after mid-September and since some people were under stronger pressure to take a job after enhanced unemployment benefits expired at the beginning of September. However, the weak payroll report of +194,000 indicated that hopes were premature for a big increase in Sep payrolls. The Aug payroll report last Friday was at least revised higher by +131,000 to +366,000 from the preliminary report of 235,000. There was also stronger labor market news with last Friday’s report that the Sep unemployment rate fell sharply by -0.4 points to a 1-1/2 year low of 4.8%.

Job gains are likely to improve substantially in October due to the sharp drop in the pandemic figures, which is likely to lead businesses to conclude that the pandemic’s resurgence on the delta variant is over and that it is safe to resume hiring and bring people back to the office. However, the October payroll figures won’t be released until just after the November 2-3 FOMC meeting.

The FOMC may decide it would not be good PR to announce QE tapering while job growth is so weak. The FOMC might decide to simply wait until the following meeting on Dec 15-16 to announce QE tapering, possibly to begin on January 1.

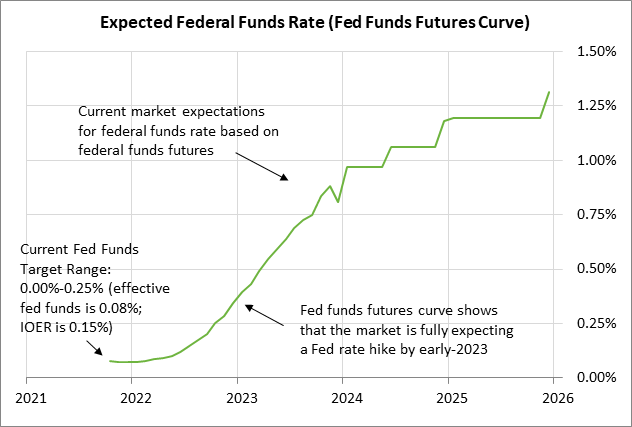

In any case, last Friday’s weak payroll report did not have much impact on expectations for when the Fed will start raising interest rates. The market is still discounting about a 50-50 chance of the Fed’s first rate hike in late 2022 and a full chance of that rate hike by early 2023.

House expected to finalize passage of the debt ceiling increase on Tuesday — The House on Tuesday is expected to approve the debt ceiling hike that the Senate passed last Thursday. The House vote would finalize the debt ceiling hike about a week ahead of next Monday’s (Oct 18) drop-dead date for a debt ceiling hike voiced by Treasury Secretary Yellen. House Speaker Pelosi had to call House members back from their recess for Tuesday’s debt ceiling vote.

The debt ceiling is only being raised through December 3, which sets up the possibility of a twin crisis for early December since the continuing resolution also expires on December 3.

Senate Majority Leader Schumer seems to want a combined spending bill and debt ceiling suspension passed by December 3. However, that is a recipe for further bipartisan conflict since Senate Minority Leader McConnell has insisted that Republicans will filibuster any debt ceiling suspension. Yet, Mr. McConnell may allow Democrats to pass a dollar-value debt ceiling hike, which Republicans would then use to pummel Democrats with campaign ads ahead of the November 2022 mid-term elections.

The debt ceiling fix through early-December gives Democrats more time to focus on trying to pass their $3.5 trillion spending bill and the $550 billion infrastructure bill. However, there may not be much near-term progress on the bills since the Senate is on recess this week for the Columbus Day holiday and the House will return to its recess after Tuesday’s debt ceiling vote. The Senate and House are both scheduled to be back on session early next week.

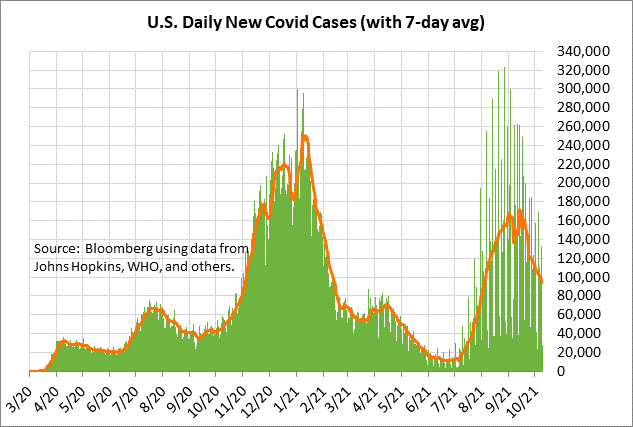

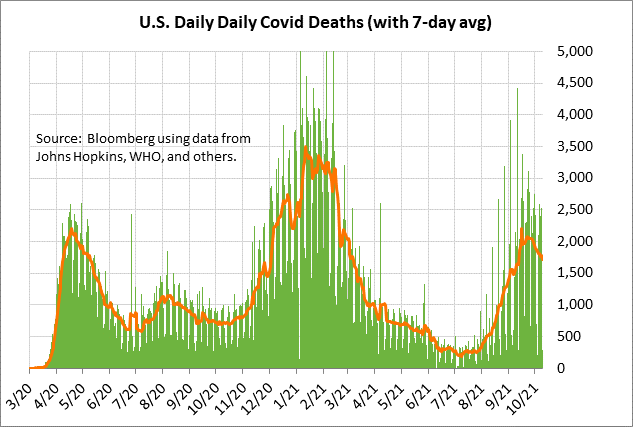

Covid infection levels continue to steadily drop — The U.S. Covid infection figures have been steadily dropping since peaking in mid-September at 171,850. The 7-day average of daily new U.S. Covid infections fell to a 2-month low of 94,068 on Saturday, down by -45% from September’s peak. There are hopes that the pandemic’s resurgence from the delta variant may be over and that infection levels will remain permanently lower. That assumes, however, that there is no new variant that causes a fresh surge in infection levels.

The good news is that the U.S. is getting closer to herd immunity, taking into account people who have been vaccinated and people who have not been vaccinated but have received some immunity after recovering from a Covid infection. Bloomberg reports that 56.4% of the total U.S. population has now been fully vaccinated. Bloomberg reports that the daily average over the past week of vaccination doses has surged to 1 million due in large part to people getting their third booster shot.