- CR must pass by today to prevent government shutdown, while debt ceiling blows in the wind

- Infrastructure vote may be slipping awayÂ

- U.S. Q2 GDP expected unrevisedÂ

- U.S. unemployment claims expected to show continued labor market improvement

CR must pass by today to prevent government shutdown, while debt ceiling blows in the wind — Congress must pass a continuing resolution by midnight Thursday, or there will be a partial federal government beginning Friday morning when the new fiscal year begins. It is possible for the House and Senate to pass a clean CR by today if Republicans do not put up any roadblocks in the Senate with a filibuster or with process delays. Democrats seem to have every intention of getting a CR passed in time to prevent a shutdown.

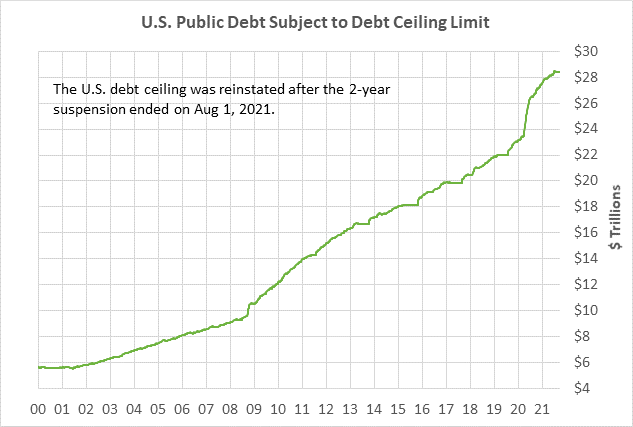

By contrast, the situation remains grim for the debt ceiling. Senate Majority Leader Schumer claims he will not use the reconciliation process to push a debt ceiling hike through the Senate because it is too uncertain and time-consuming. However, reconciliation is the only way for the Senate to pass a debt ceiling hike given Republican opposition.

The only other alternative would be if Mr. Schumer could convince all 50 Democratic Senators to change Senate rules and strip the filibuster privilege from Republicans for a debt ceiling vote. However, the White House says it opposes stripping the filibuster and several Democratic Senators are likely to be opposed to that idea as well.

The Schumer-Pelosi strategy seems to be to threaten not to use reconciliation to raise the debt ceiling, with the idea that any plunge in the stock market would increase the pressure on Republicans to drop their filibuster. However, Republicans seem to be implacably opposed to doing anything to help with a debt ceiling hike. Democrats therefore seem to be headed down a dead end street, wasting the precious time that is needed to push a debt ceiling hike through Congress with reconciliation.

The markets could get increasingly anxious about this high-risk approach to resolving the debt ceiling. Treasury Secretary Yellen earlier this week set October 18 as the drop-dead date for a debt ceiling hike, which is now less than three weeks away.

Infrastructure vote may be slipping away — House Democratic leaders on Wednesday said they still intend to proceed with a vote today on the $550 billion infrastructure bill. However, Ms. Pelosi is likely to delay a vote if she doesn’t have the votes.

Progressive Democrats are playing hardball and are refusing to vote for the infrastructure bill while the reconciliation bill is still up in the air. Democratic Senators Manchin and Sinema are refusing to name a top-line spending figure they would support, which makes a final deal impossible to reach.

The stock market has mixed feelings about the infrastructure and reconciliation bills. The stock market wants to see the infrastructure spending, which would provide direct fiscal stimulus to the economy. The spending from the reconciliation bill would also give the economy a boost. At the same time, the stock market is pleased to see a delay in the corporate tax hike that is contained in the reconciliation bill. The corporate tax hike would take a direct bite out of after-tax earnings, and thus out of stock prices as well.

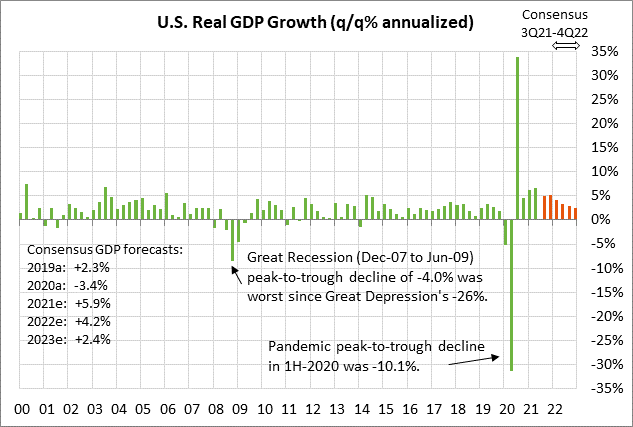

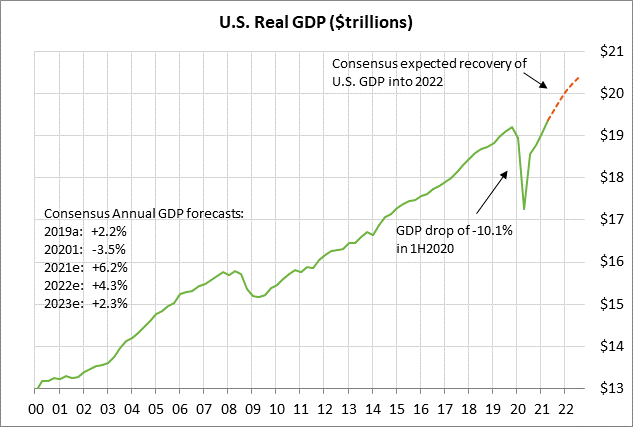

U.S. Q2 GDP expected unrevised — The consensus is for today’s Q2 GDP to be left unrevised at +6.6% (q/q annualized). Q2 personal consumption is expected to be unrevised at +11.9%. Today’s GDP report is not likely to have much market impact since Q2 was over a long time ago, and the focus is on next month’s report for Q3 GDP.

The consensus is that GDP growth peaked at +6.6% in Q2 and will ease to +5.0% in Q3 and +5.1% in Q4. Growth is expected to slow as pent-up demand fades and as consumers cut back on spending since most of their stimulus check money ran out a long time ago. Also, the economy continues to be hobbled by a host of obstacles, including component and chip shortages, delays and high costs in shipping, and labor market shortages.

On a calendar year basis, GDP growth this year is expected at +5.9%, more than overcoming last year’s -3.4% decline. However, GDP growth is expected to fade to +4.2% in 2022 and to +2.4% in 2023, returning to more normal levels. The FOMC, in its Summary of Economic Projections, pegs the longer-run U.S. GDP rate at +1.8%. The FOMC is predicting that GDP growth in 2021 will rise to +5.9%, but then fade to +3.8% in 2022, +2.5% in 2023, and +2.0% in 2024.

The markets are waiting to see whether Democrats will be able to pass the $550 billion infrastructure bill and a reconciliation spending bill that is targeted at $3.5 trillion. Those spending measures would provide some additional fiscal stimulus over the coming years that would boost GDP.

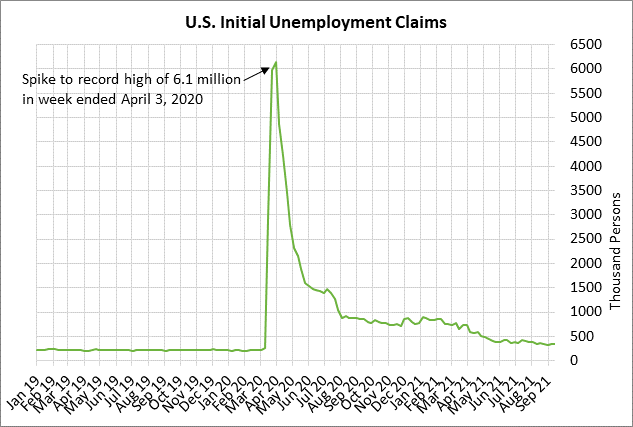

U.S. unemployment claims expected to show continued labor market improvement — Today’s unemployment claims report is expected to show a continued improvement in the U.S. labor market. The consensus is for today’s initial unemployment claims report to show a -21,000 decline to 330,000, more than reversing last week’s +16,000 rise to 351,000. Continuing claims are expected to fall by -45,000 to 2.800 million, reversing part of last week’s +131,000 rise to 2.845 million.

Both the initial and continuing claims series are near their recent lows. Initial claims are +39,000 above the 19-month low of 312,000 posted in the week ended Sep 3, while continuing claims are 131,000 above the 19-month low of 2.714 million posted in the week ended Sep 3. Relative to the pre-pandemic levels, initial claims are elevated by only +135,000, and continuing claims are elevated by 1.137 million.