- Stocks fall sharply on combination of yield surge and debt ceiling risks

- Yellen sets drop-dead date of October 18 for the debt ceiling

- Pelosi still plans Thursday infrastructure vote

- U.S. pending home sales expected to show small increase

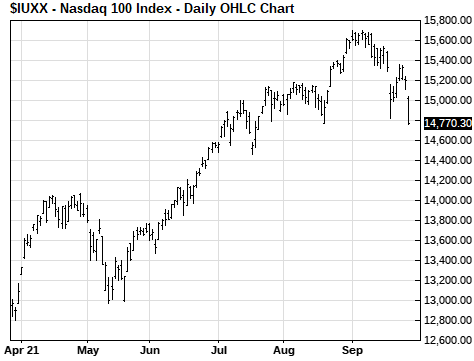

Stocks fall sharply on combination of yield surge and debt ceiling risks — The S&P 500 index on Tuesday fell sharply by -2.04%, and the Nasdaq 100 index fell by -2.86%. The sharp sell-off in stocks was due to (1) the continued rise in Treasury yields, (2) Treasury’s Secretary Yellen’s drop-dead date of October 18 for a debt ceiling hike, (3) weakness in tech stocks due to valuation concerns with the rise in Treasury yields, and (4) the lack of progress on getting the infrastructure and reconciliation bills passed, which delays new fiscal stimulus for the economy.

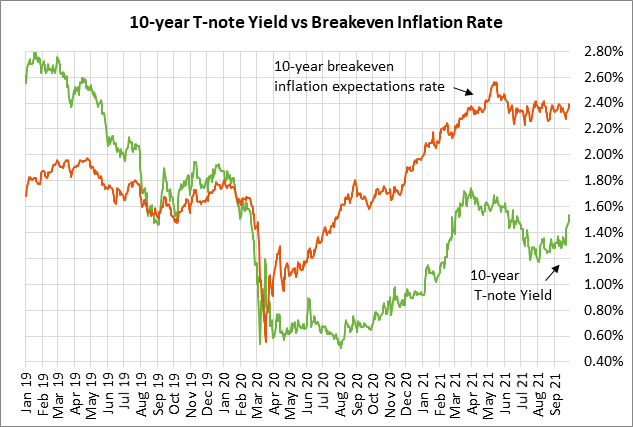

The 10-year T-note yield on Tuesday rose to a new 3-1/2 month high of 1.57% and closed the day up +5 bp at 1.54%. The 10-year T-note yield has now surged by +21 bp since last week’s hawkish FOMC meeting.

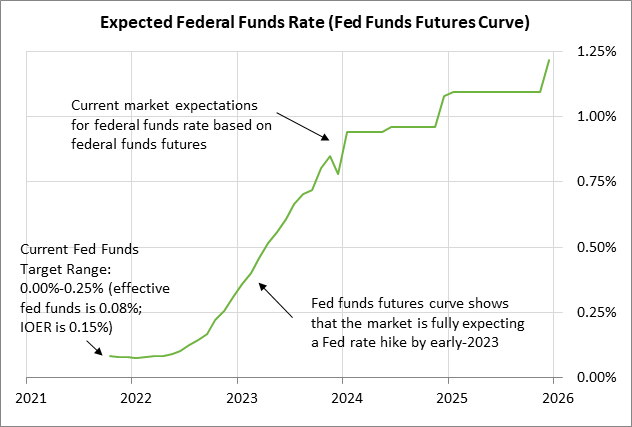

The Dec 2022 federal funds futures contract (on a yield basis) has risen by +8 bp since last Tuesday to yesterday’s close of 0.31%, reflecting 92% odds for a +25 bp rate hike by the end of 2022 from the current funds rate level of 0.08%.

The FOMC last week made clear that QE tapering is likely to be officially announced at the next FOMC meeting on November 1-2. Also, FOMC members became more hawkish on their dot-plot forecasts, with half of the FOMC members now forecasting at least one rate hike by the end of 2022. The dot-plot indicated a median forecast that the Fed will raise its funds rate to 1.0% by the end of 2023.

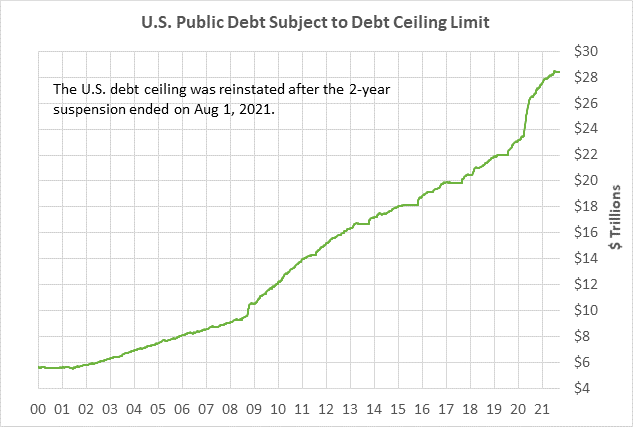

Yellen sets drop-dead date of October 18 for the debt ceiling — Treasury Secretary Yellen on Tuesday released a letter stating that the Treasury on October 18 will have effectively run out of cash and may start defaulting on its obligations. She said that the failure of Congress to raise or suspend the debt ceiling could produce “catastrophic” results and cause a recession.

The markets were a bit taken aback that Ms. Yellen was willing to set a drop-dead date. Also, the date was on the earlier side of recent expectations. The Bipartisan Policy Center last Friday estimated that the Treasury’s X-date would fall somewhere between October 15 and November 4.

Democrats have very few options left for addressing the debt ceiling since Republicans on Monday filibustered the attempt to pass the combined continuing resolution and debt ceiling suspension. Senate Majority Leader Schumer on Tuesday tried to get unanimous consent in the Senate to approve a debt ceiling hike by a majority vote. However, that was quickly shot down by Republican Senators who objected.

Mr. Schumer could still conceivably take the nuclear route of getting Democrats to vote for a rules change to disallow the filibuster from being used to block a majority vote on the debt ceiling. However, that could start a slippery slope towards doing away with the minority party’s filibuster rights altogether, which several moderate Democratic Senators oppose. Mr. Schumer would likely have trouble getting all of his 50 Democratic Senators to agree to do away with the filibuster on debt ceiling votes, although that opposition might ease if the markets go into a melt-down mode.

The only other alternative is for the Senate to use the budget reconciliation process to pass a debt ceiling hike, allowing the Senate to pass a debt ceiling hike with a majority vote. However, there is disagreement over whether that process would take too long since it would require new votes in the Senate and House and a new vote-a-rama in the Senate. If Democrats are going to use the reconciliation process to raise the debt ceiling, then they need to get started immediately.

The markets remain worried that Democrats and Republicans might push their brinkmanship one step too far and cross the line by defaulting on Treasury obligations. There continues to be uncertainty as to whether the Treasury could prioritize the payment of interest and principal on Treasury securities, with the Treasury using incoming tax revenues to prevent a sovereign debt default. The Treasury in the past has said it doesn’t have the capability or the legal authority to prioritize Treasury security payments, but many suspect that the Treasury could in fact get interest and principal paid in an emergency.

Yet even if the Treasury doesn’t default on its securities debt, it would start missing other payments shortly after October 18 on priorities such as paying vendors, paying federal employees including the military, making Social Security payments, etc.

The inability of the U.S. government to make good on its financial obligations would be another example of the devolution of U.S. politics into complete dysfunction, and the decline of American civilization in general. Foreign investors would have another reason not to trust the United States.

Pelosi still plans Thursday infrastructure vote — House Speaker Pelosi so far still plans to hold a vote on Thursday on the $550 billion infrastructure bill. Ms. Pelosi is trying to get progressive House Democrats to support the infrastructure bill if she at least has a framework agreement on a reconciliation package among all House and Senate Democrats and the White House. Ms. Pelosi already admitted that the package will be smaller than $3.5 trillion.

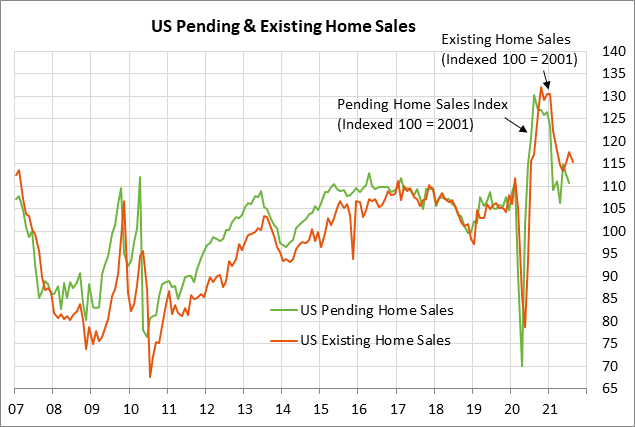

U.S. pending home sales expected to show small increase — The consensus is for today’s Aug pending home sales report to show a +1.0% m/m increase, recovering part of July’s -1.8% decline. Pending home sales have fallen this year as sales cool from the pandemic spike, but home sales remain in relatively strong shape at levels mildly above pre-pandemic levels.