- Weekly market focus

- U.S. legislative crunch arrives

- Markets will watch Fedspeak for timing of QE tapering

- U.S. Covid infection rate falls to 1-1/2 month low

Weekly market focus — The markets this week will focus on (1) the legislative crunch in Washington, (2) continued concern about how the Evergrande debt crisis will unfold, (3) whether the U.S. Covid infection rate starts to fade, (4) a busy week for Fedspeak as Fed officials are likely to push last week’s FOMC meeting theme that QE tapering will come “soon,” (5) the Treasury’s sale of 2-year and 5-year T-notes today and 7-year T-notes on Tuesday, and (6) a busy U.S. economic calendar

U.S. legislative crunch arrives — Congress must pass a continuing resolution (CR) by Thursday, or there will be a partial U.S. government shutdown on Friday. Congress has a little longer to pass a debt ceiling hike (or suspension) since the Treasury’s X-date won’t come any sooner than October 15, according to updated analysis from the Bipartisan Policy Center. The BPC now pegs the X-date somewhere between October 15 and November 4.

The Senate today is expected to vote on the combined CR and debt ceiling suspension bill that the House passed last week. However, the measure is not expected to pass the Senate because Senate Republicans are expected to filibuster the bill due to the inclusion of a debt ceiling suspension. It will then be up to Democrats to determine whether they are willing to strip out the debt ceiling suspension and just pass a clean CR, which would avert a government shutdown on Friday. It seems clear that the Republicans will not blink on opposing a debt ceiling suspension or increase.

There has been no word from Democrats on any Plan B for passing a debt ceiling hike or suspension. Democrats could pass a debt ceiling hike through reconciliation, but it is unclear whether there is enough time before the Treasury’s X-date. Senate Minority Leader McConnell says it could be done in a week, but Democratic leaders say it would take longer.

House Speaker Pelosi said last Friday that the House will vote today on the $550 billion infrastructure bill. If the House passes the same bill as the Senate version, then it would go to President Biden for his signature, although Ms. Pelosi could delay sending the bill to the White House for a signature. House progressives have said they will vote against today’s infrastructure bill because the $3.5 trillion reconciliation bill isn’t ready. Ms. Pelosi hopes to present the reconciliation bill later this week in the House for a vote.

Even if the House can pass a $3.5 trillion reconciliation bill this week, the prospects for the bill look dim in the Senate where it faces strident opposition from West Virginia Senator Manchin. Mr. Manchin has not only called for a much smaller bill, but he has also called for pausing the consideration of the bill altogether. Mr. Manchin continues to play coy and refuse to say what top-level spending level he would accept. As a result of opposition from Mr. Manchin and other moderate Democrats in both the House and Senate, final passage of the reconciliation could be delayed for a matter of weeks.

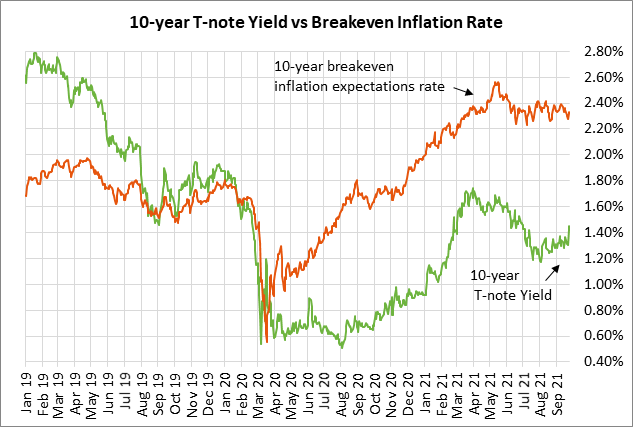

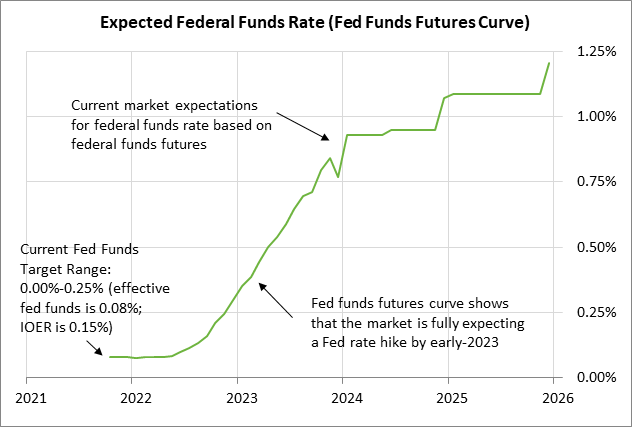

Markets will watch Fedspeak for timing of QE tapering — The markets this week will carefully sift through various comments from Fed officials to gain any new insights into when the Fed will begin tapering QE and when the first interest rate hike will occur.

The market consensus is that the FOMC at its next meeting on November 1-2 will formally announce QE tapering. Last week’s FOMC’s post-meeting statement said, “The economy has made progress toward these goals. If progress continues broadly as expected, the Committee judges that a moderation in the pace of asset purchases may soon be warranted.” Fed Chair Powell said last week that the tapering program will likely be concluded by mid-2022.

The markets are discounting about a 50-50 chance of a rate hike by the end of 2022 and a full chance of a rate hike by early-2023. That is in line with last week’s updated dot-plot, in which half the 18 FOMC members expect at least one rate hike by the end of 2022, and the other half are expecting an unchanged rate. The dot-plot indicated a median forecast that the Fed will raise its funds rate three times for an overall rate hike to 1.0% by the end of 2023.

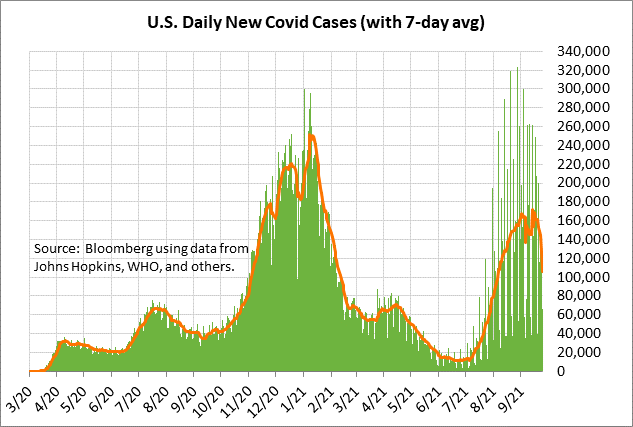

U.S. Covid infection rate falls to 1-1/2 month low — The markets are hoping that the recent resurgence in the pandemic due to the delta variant may have peaked. The 7-day average of new U.S. Covid infections last Friday fell to a 1-1/2 month low of 105,874, down by -38% from the 8-month high of 171,850 posted on September 13.

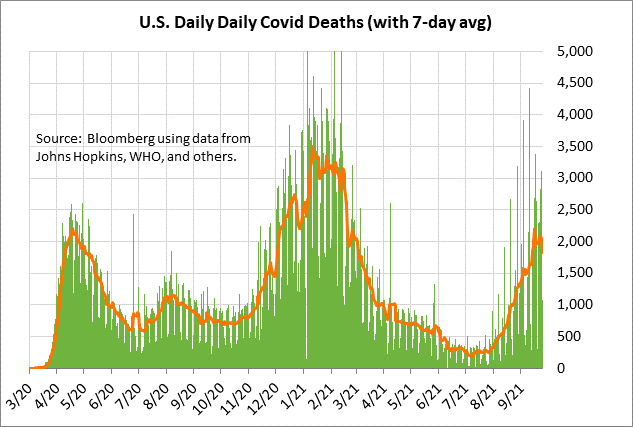

Also, there is hope that the Covid death rate peaked after the 7-day average of daily U.S. Covid deaths fell to 1,822 last Friday, down by -17% from the 7-month high of 2,203 posted on September 16.

The U.S. vaccination level continues to slowly climb, although the U.S. is still far away from herd immunity. The CDC reports that 55.1% of the U.S. population is now fully vaccinated against Covid, and 64.1% have received at least one vaccination dose.

Bloomberg reports that an average of 683,466 doses per day was administered over the past week, down from recent levels in the 700,000 range. However, the daily vaccination rate may start climbing in the coming weeks as the U.S. gears up to administer a third booster shot. The third booster shot should, in theory, help slow break-through Covid infections.