- Legislative crunch time comes next week

- Markets wait to see if a QE tapering announcement will come at next week’s FOMC meetingÂ

- U.S. consumer sentiment expected to partially recover from 10-year low

Legislative crunch time comes next week — The House returns next Monday from their summer recess and the legislative crunch time will begin. The Senate already returned from its recess earlier this week.

The first order of business for the House next week will be to pass a continuing resolution to providing funding authorization for the federal government for the next fiscal year that begins on October 1. Without a continuing resolution, there will be a partial government shutdown starting on October 1.

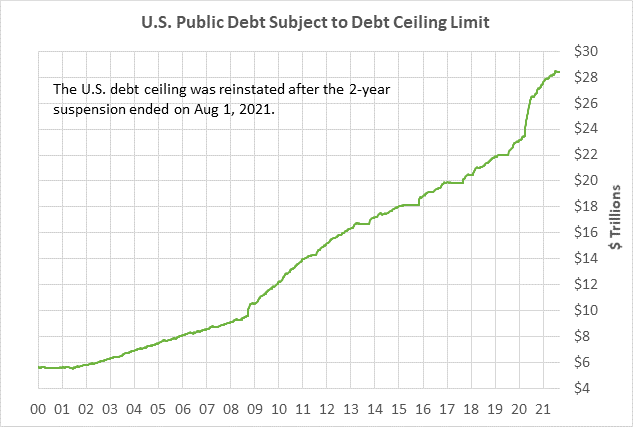

The continuing resolution (CR) is expected to be controversial because Democratic leaders have indicated they plan to attach a debt ceiling hike (or suspension) to the CR. Democrats also plan to include hurricane relief in the CR.

Democrats are hoping they can pressure Senate Republicans into passing the CR and debt ceiling under regular order, lest the Republicans be blamed for the combination of a government shutdown, Treasury default, and a failure to provide aid to hurricane victims.

However, Senate Republicans have vowed stiff resistance to a debt ceiling hike and it may prove impossible to get the 10 Republican votes that would be necessary to overcome a filibuster. Republicans have said they will refuse to allow a debt ceiling hike to pass because of Democrat’s plan to pass a $3.5 trillion spending plan that they oppose. Democrats counter that by saying that the debt ceiling hike is necessary to cover financial obligations incurred by previous presidential administrations, including the $7.8 trillion of debt incurred during the Trump administration.

Democrats and Republicans have indicated no flexibility and appear to be on a collision course towards a debt ceiling crisis. Both sides are essentially betting that a stock market sell-off would pressure the other side to act. Democrats could pass the bill without Republican help if they wished by putting it into the reconciliation bill. However, it is unclear whether Democrats could even pass a reconciliation bill by the time the Treasury’s X-date arrives in late October or early November.

Aside from the upcoming crisis over the continuing resolution and debt ceiling, House Speaker Pelosi has promised moderate House Democrats that she will hold a vote on the $550 billion infrastructure bill by September 27. If House Democrats were to approve the same bill that has already been passed by the Senate, then Congressional approval would be complete and it would go to President Biden’s desk for his signature. However, it seems more likely that Ms. Pelosi will encourage the House on September 27 to pass a slightly different bill so that the infrastructure bill is not finalized and she can continue to use the bill as leverage to force moderate Democratic Senators to vote for the $3.5 trillion reconciliation bill.

Ms. Pelosi has not indicated when she will hold a House vote on the $3.5 trillion reconciliation bill. However, the House Ways and Means Committee earlier this week took a big step forward by approving the key tax portions of the legislation. The reconciliation bill faces a torturous path forward due to opposition from moderate Democratic House and Senate members.

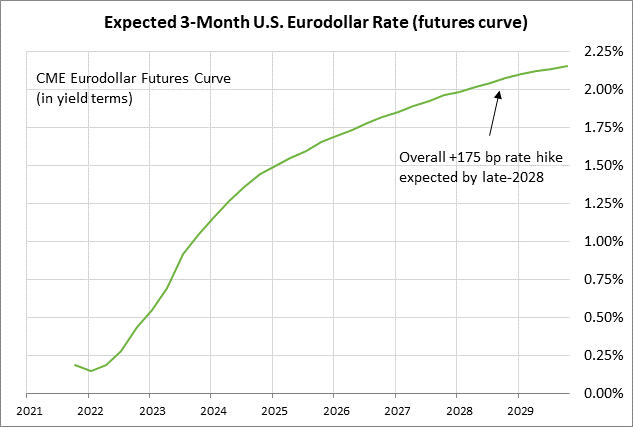

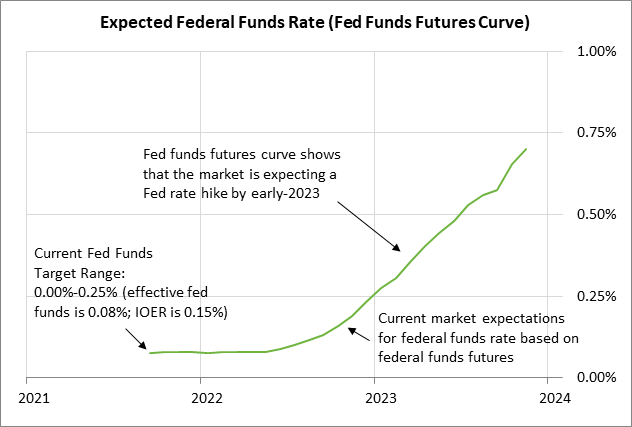

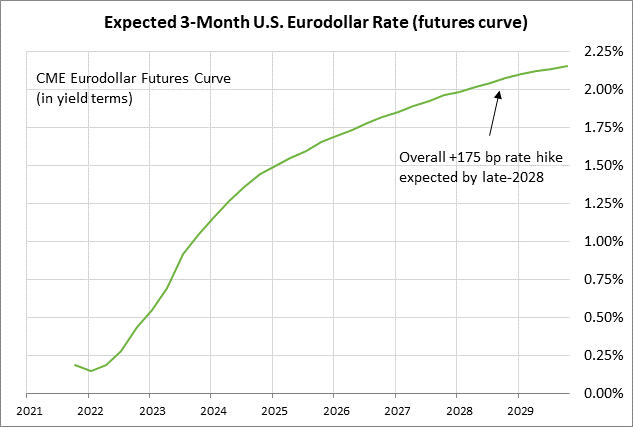

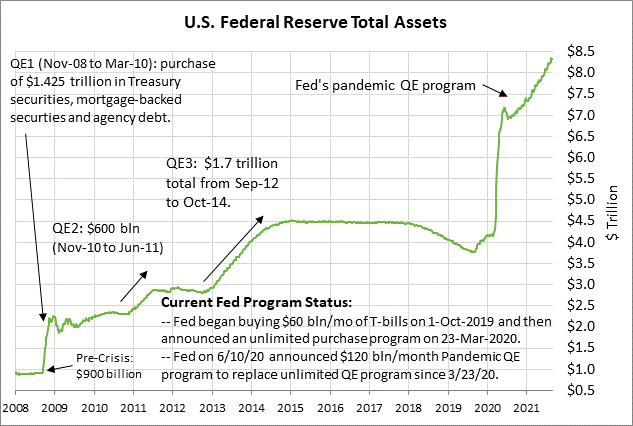

Markets wait to see if a QE tapering announcement will come at next week’s FOMC meeting — The markets are on guard for the possibility that the FOMC at its meeting next Tue/Wed (Sep 21-22) might officially announce QE tapering.

Fed Chair Powell at the Jackson Hole conference on Aug 27 indicated that the conditions have been met for QE tapering. He said the Fed believes that the economy has now met the test of “substantial further progress” toward the Fed’s inflation objective and that the labor market has also made “good progress.” He said that at the last FOMC meeting in late July, “I was of the view, as were most participants, that if the economy evolved broadly as anticipated, it could be appropriate to start reducing the pace of asset purchases this year.”

Since the July FOMC meeting and the Jackson Hole conference, however, the Fed received some bad economic news when Aug payrolls rose by only +235,000, much weaker than expectations of +730,000. The markets suspect that the Fed may defer a QE tapering announcement until the November or December FOMC meeting to give the Fed more time to assess whether the labor market is losing ground due to the pandemic’s resurgence.

Aside from QE tapering, the markets were pleased that Mr. Powell in his Aug 27 Jackson Hole comments went out of his way to stress that the beginning of QE tapering will not bring interest rate liftoff any closer. He said, “The timing and pace of the coming reduction in asset purchases will not be intended to carry a direct signal regarding the timing of interest rate liftoff, for which we have articulated a different and substantially more stringent test.”

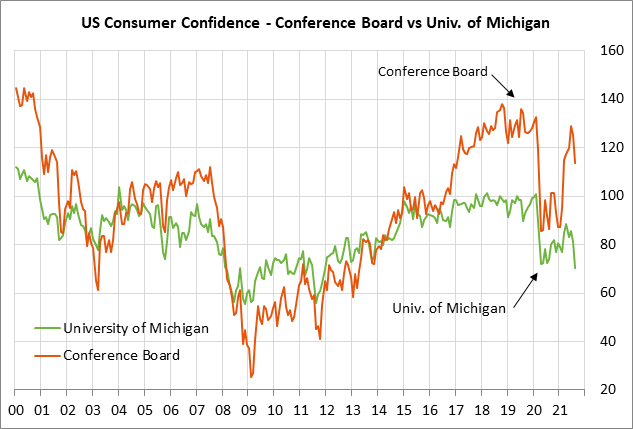

U.S. consumer sentiment expected to partially recover from 10-year low — The consensus is for today’s preliminary-Sep University of Michigan U.S. consumer sentiment index to show a +1.7 point increase to 72.0, partially recovering after August’s -10.9 point to a 10-year low of 70.3. The index in August fell below even the worst level seen during the height of the pandemic last April.

Consumer sentiment has taken a sharp hit from the pandemic’s resurgence and the revival of various restrictions. Consumers are also on the defensive due to inflation and the high price of gasoline. However, consumer sentiment could recover fairly quickly if the pandemic starts to fade again.