- U.S. weekly unemployment claims expected to show continued labor market improvement

- U.S. factory orders expected to show small increase

- U.S. trade deficit expected to narrow from June’s record

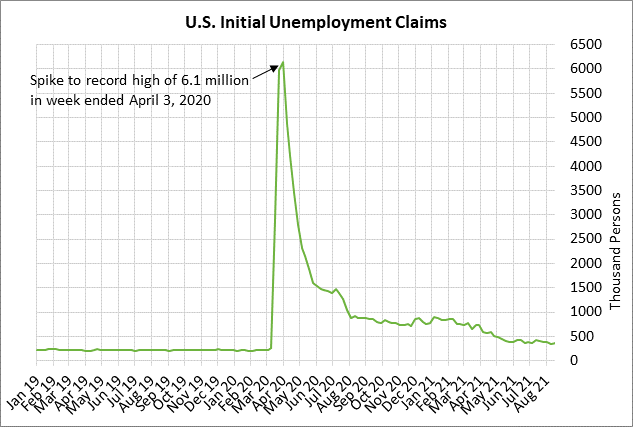

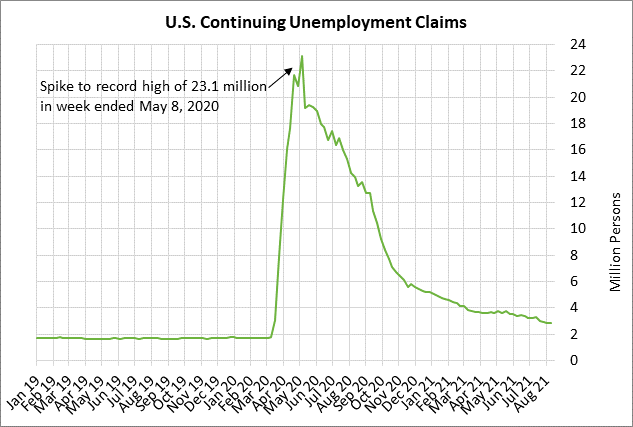

U.S. weekly unemployment claims expected to show continued labor market improvement — Today’s weekly unemployment claims report is expected to show a continued improvement in the U.S. labor market. The consensus is for today’s initial unemployment claims report to show a -8,000 decline to 345,000, more than reversing last week’s small +4,000 increase to 353,000. Today’s continuing claims report is expected to show a decline of -52,000 to 2.810 million, adding to last week’s small -3,000 decline to 2.862 million.

Initial unemployment claims are currently just slightly above the 1-1/2 year low of 349,000 posted in the week ended August 13. Continuing claims last week fell to a new 1-1/2 year low. Relative to the pre-pandemic level, initial claims are now elevated by only +137,000 and continuing claims are elevated by only 1.154 million.

On the labor front, the markets are mainly looking ahead to Friday’s unemployment report, which will be a critical factor in the FOMC’s decision at its meeting in three weeks (Sep 21-22) on whether to announce QE tapering.

Strong payroll data for August could convince the FOMC that it is safe to go ahead with QE tapering even though the pandemic is still raging. By contrast, if the August labor market data is weak, then the FOMC may decide to delay a tapering decision until its next meeting on Nov 2-3 as it waits to gauge the size of the hit to the U.S. economy from the pandemic’s resurgence.

The consensus for Friday’s August payroll report is for a large increase of +750,000. Payrolls have been very strong in the past three months, with a monthly average of +832,000 (May +614,000, June +938,000, July +943,000). Expectations for Friday’s payroll report were undercut by Wednesday’s Aug ADP employment report, which rose by only +374,000, weaker than expectations of +625,000.

The markets are waiting to see whether businesses are pulling back on their hiring plans due to the pandemic’s resurgence, which has caused some businesses to delay plans to return to the office and institute mandatory vaccination rules. Increased pandemic restrictions are particularly damaging for the restaurant, travel, and entertainment industries.

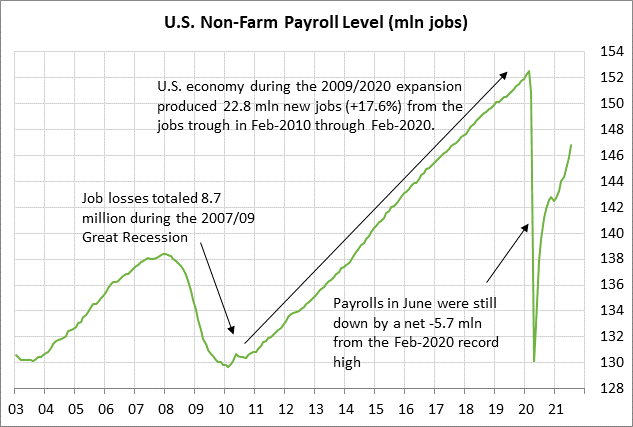

A pull-back in hiring would disrupt the Fed’s plans since the U.S. labor market still has a long way to go before returning to health. The U.S. economy must produce another 5.7 million jobs to get the payroll job level back up to the pre-pandemic record high seen in February 2020.

The consensus is for Friday’s Aug unemployment rate to show a -0.2 point decline to 5.2%, adding to July’s sharp -0.5 point decline to a 16-month low of 5.4%. July’s drop in the unemployment rate to 5.4% was a welcome development since the unemployment rate is now only 1.9 points above the pre-pandemic record low of 3.5%.

However, the Fed knows that the unemployment rate will be increasingly difficult to push lower since more people are likely to come back into the labor market as jobs increase. The increased pool of available workers will keep upward pressure on the unemployment rate.

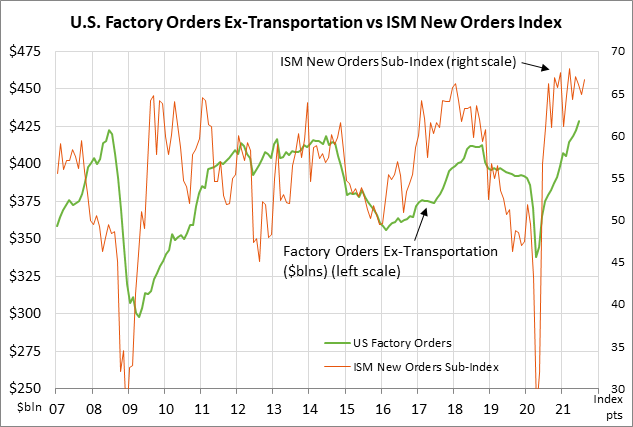

U.S. factory orders expected to show small increase — The consensus is for today’s July factory orders report to show a small increase of +0.3% m/m following June’s solid report of +1.5% m/m and +1.4% m/m ex-transportation.

U.S. factory orders are in strong shape as the businesses place orders and try to catch up with the reopening surge. In June, U.S. factory orders were up +22% y/y and were +9.3% above the pre-pandemic level.

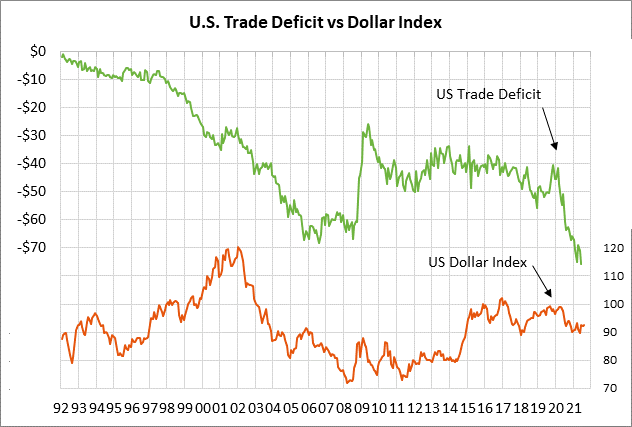

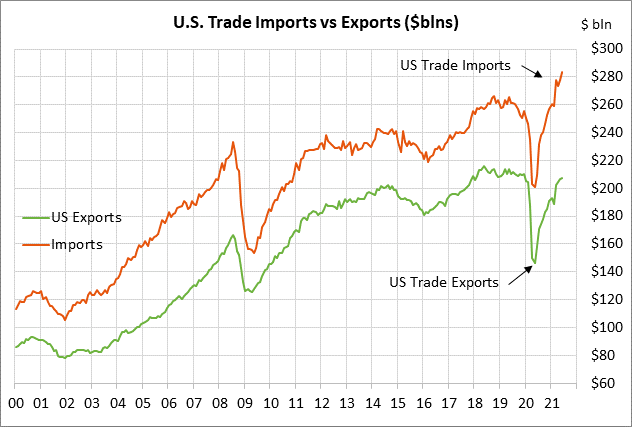

U.S. trade deficit expected to narrow from June’s record — The consensus is for today’s July trade deficit to narrow to -$70.9 billion from June’s record high of -$75.7 billion (data since 1992). The surge in the U.S. trade deficit is due to the effects of the pandemic. U.S. exports have been hurt by weak overseas economic growth. By contrast, U.S. imports have been very strong because of the massive amount of stimulus that has been pumped into the U.S. economy.

In June, U.S. imports were up by +35.3% y/y while U.S. exports were up by a lesser +30.8% y/y. U.S. imports are far above the pre-pandemic level, while U.S. exports have yet to rise above the pre-pandemic level.

On the trade front, the Biden administration has taken a hawkish trade stance toward China and has so far shown no interest in dropping Trump-era tariffs. The U.S. still has a 25% penalty tariff on about $250 billion of Chinese goods and a 7.5% tariff on $120 billion of Chinese goods. Meanwhile, China still has tariffs on virtually all of the goods that it imports from the U.S.

The Biden administration also says it expects China to live up to its obligations from the phase-one trade deal to purchase $200 billion of extra goods from the U.S. during 2020-21. China is far behind on its purchase obligations, but the Biden administration has not threatened any consequences if China doesn’t fully meet its purchase obligations.

By contrast, the Biden administration has shown interest in settling the U.S. trade tiff with Europe over Boeing/Airbus and reducing Trump-era tariffs on European goods.